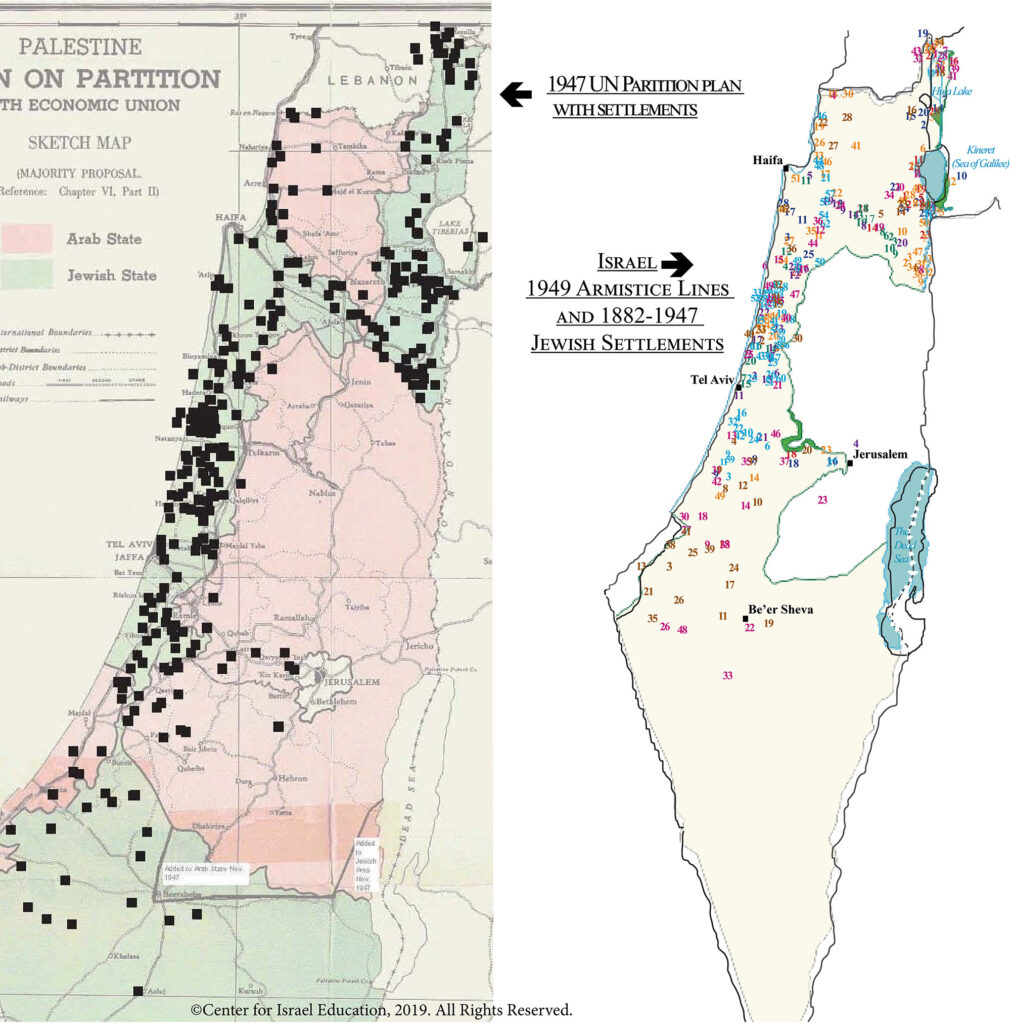

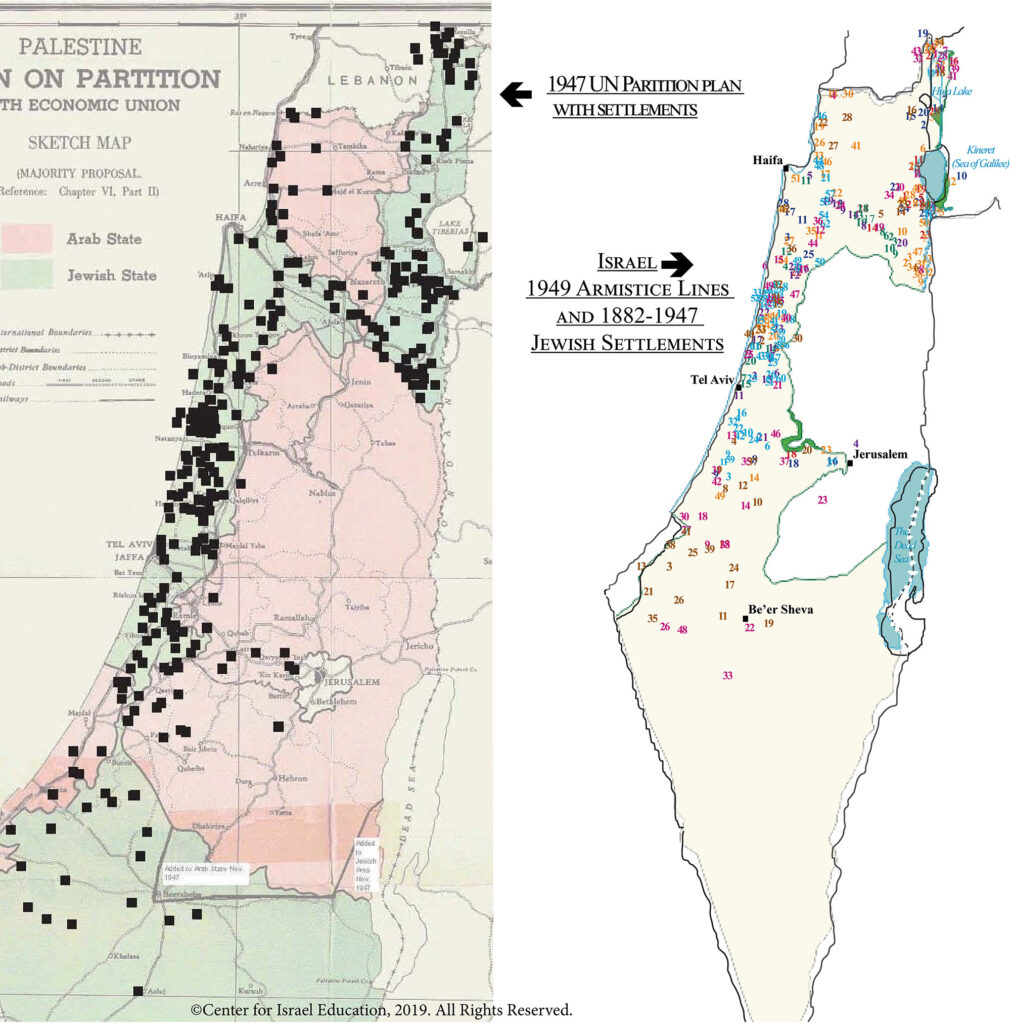

By Ken Stein and Scott Abramson, March 23, 2025 Jewish physical growth in Mandatory Palestine in the period known as the New Yishuv was sufficient through land acquired from Arabs by 1939 for the Jewish...

By Topic

Find content relevant to your specific interests or area of study.

By Type

Choose the format that best suits how you want to engage with the content.

By Language

Access content in the language that best supports your learning.

By Era

Explore content organized by historical period to focus your learning by timeframe.

View this article in: Hebrew

By Ken Stein and Scott Abramson, March 23, 2025 Jewish physical growth in Mandatory Palestine in the period known as the New Yishuv was sufficient through land acquired from Arabs by 1939 for the Jewish...

Israel is competing in bobsled, alpine and cross-country skiing, skeleton, and figure skating at the 2026 Winter Olympics in Milan and Cortina, Italy.

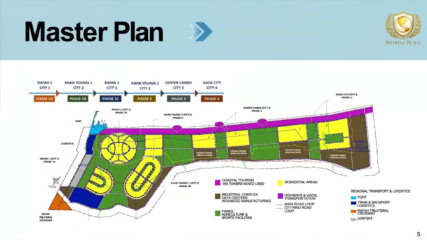

While the Palestinian official leading the technocratic Gaza administration promises to open the Rafah Crossing and the Bulgarian high commissioner for Gaza urges the world to focus on the big picture, U.S. envoy Jared Kushner lays out a vision for Gaza as a rapid, phased real estate redevelopment.

A Zionist delegation to the Paris Peace Conference makes an effective, largely successful case for the League of Nations to incorporate a future Jewish national home into the British Mandate for Palestine.

The Trump administration’s proposed charter for the Board of Peace, the body the United Nations has charged with overseeing the Gaza ceasefire, does not mention Gaza or any other specific location of operation but does grant its chairman, Donald Trump, extensive control over its mission and operations.

Three years after the Israeli government began the process to overhaul the judiciary, and after two years of war delayed efforts, the drive to rein in judicial independence continues.

Former Supreme Court President Aharon Barak makes the case against the Netanyahu government’s efforts to overhaul the judiciary, arguing that Israeli democracy requires judicial independence and protection for minority rights.

Supreme Court President Yitzhak Amit warns about the danger to the Israeli public and democracy of sustained political attacks on the judiciary and individual judges.

Updated January 5, 2026; originally posted October 2023. By Ken Stein CIE+ Reliable resources for deeper Israel understanding Embrace informed content on Israel, the Middle East and the Diaspora. Begin with 7 days free to…

A week of unrest in Iran does not guarantee a revolution even if 85-plus million Iranians are angry at the country’s autocratic, theological rulers. Iran is a security-clerical oligarchy where kleptocracy, cronyism and authoritarianism have…